Eurobond

Foreign currencies’ balance in Egypt’s international reserves increased to $39 billion in March 2018, up from $25 billion in March 2017.

Egypt’s Ministry of Finance raised up to €2B in dual-tranche eurobond on Monday recording the country’s first public bond denominated in euro.

A wrap-up of the most prominent business news of the day.

Egypt has already raised $4 billion through a triple-tranche bond in February.

A wrap-up of the most prominent business news of the day.

The Finance Ministry will issue its anticipated euro denominated Eurobonds on the Luxembourg stock exchange in three weeks.

The Eurobond, which will raise $4 billion to $5 billion, was initially slated for the end of January.

The banks are J.P. Morgan, Morgan Stanley, Citibank, HSBC and National Bank of Abu Dhabi.

A wrap-up of the most prominent business news of the day.

Egypt’s government approved a Eurobond programme worth around $7 billion to be issued during the 2017-2018 fiscal year that began in July.

Egypt plans to issue a third round of Eurobonds at a total value of $3-4 billion in the first quarter of 2018.

Egypt will issue U.S. dollar- denominated bonds during the period between January and March 2018.

Global financial service provider Deutsche Bank has a positive near-term outlook for Egypt on strengthening the economy.

Egypt’s foreign reserves soared $2.48 billion in one month to reach $31.125 billion at the end of May, the Central Bank of Egypt (CBE) said on Sunday.

Egypt's foreign reserves are predicted to rise in May and June as an influx of foreign currency is expected to reach the state coffers in the near term.

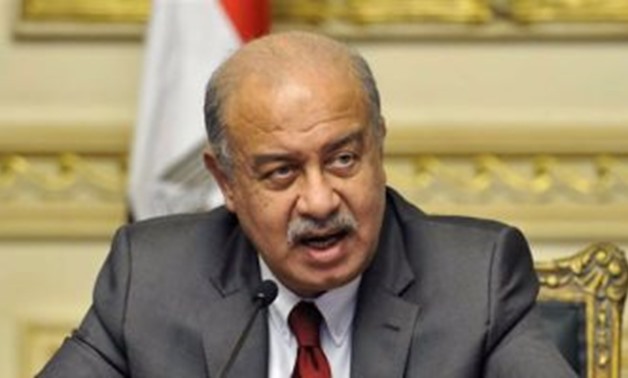

Egyptian Finance Minister Amr El Garhy said that the country's $3 billion Eurobond sale would cover "to a large extent" its financing needs.

Egypt will issue a Eurobond of between $1.5 billion and $2 billion within the next week.

The government is planning to issue a second round of dollar-denominated Eurobonds worth $2 billion by mid-May, official sources told Al-Borsa newspaper.