CAIRO - 27 February 2019: The Ministry of Information and Communication Technology announced its intention to attract foreign investments from international companies to set up centers in Egypt, in a move to increase competitiveness, the quality of service provided and raise the exports of the Information and Communications Technology (ICT) sector.

The sector was affected when Egypt imposed development fees on new SIM cards and restricted the sale of these cards in the branches of mobile companies in a bid to audit data. This led to the loss of 7 million mobile subscribers in the first 10 months of 2018, in contrast to fixed telephone subscriptions that jumped by 1.3 million. Egypt has four mobile networks operating in the market, including: Vodafone Egypt, Orange Egypt, Etisalat Egypt and Telecom Egypt (WE).

Development fees were imposed after the latest amendments to Law No. 147 of 1984, concerning the imposition of a fee for the development of the state's financial resources, was approved in the parliament. The fees are imposed to improve the services provided for citizens in several fields, including traffic, arms licensing, passport issuance and work permits.

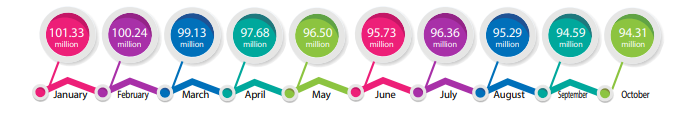

From January to October 2018, the number of mobile subscribers witnessed several ups and downs; the number of used SIMs dropped from 101.33 million at the end of January 2018 to 100.24 million by the end of February to reach 99.13 million by the end of March. Then, it fell again from 97.68 million at the end of April to 96.50 million at the end of May and 95.73 million at the end of June. Before rising to 96.36 million for the first time at the end of July and then falling back to 95.29 million at the end of August, it reached 94.59 million and 94.31 million by the end of September and October, respectively.

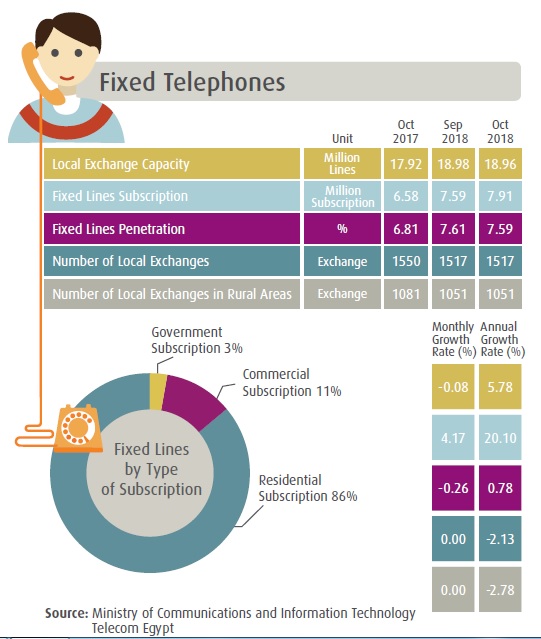

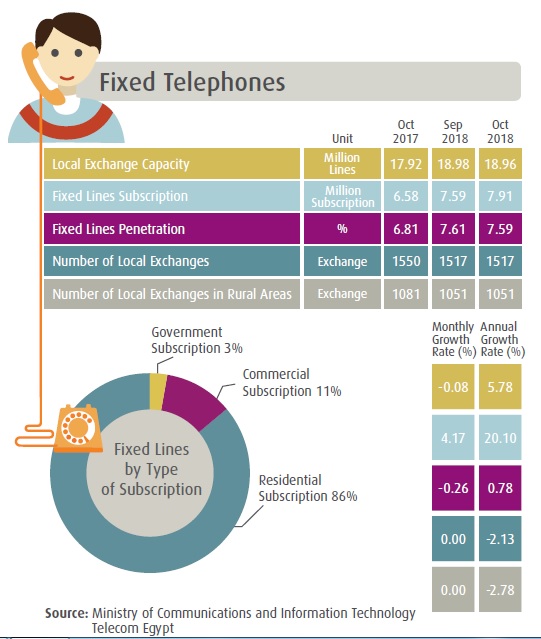

On the other hand, the number of fixed telephone subscribers increased from 6.61 million at the end of January 2018 to 7.91 million at the end of October, with an increase of 1.3 million new subscribers, whereas the waiting list measures at 163,000. This is attributed to an increase in the number of individuals who get home phones for Internet use—to connect ADSL, which stand at about 980,000 new subscribers.

Network companies in Egypt, a major player in the Egyptian communications system and the economy in general, provide direct and immediate communication service, which reflects positively on the private sector in the speed of decision-making and the conclusion of transactions, contracts and the management of economic institutions with high efficiency. The volume of huge investments these companies pumped into the arteries of the economy exceeded LE 140 billion for foreign mobile companies alone; that is in addition to its future role in the implementation of state plans towards financial inclusion.

CEO of the Institutional Sector at Etisalat Egypt Khaled Hegazy attributes the declining number of subscribers coming to a halt on the buying phenomenon of some SIMs taking benefit of companies’ offers. This reportedly came following government decrees to reduce the outlets selling SIM cards, and the new cards’ high pricing points resulted from the imposition of development fees.

“These customers stopped buying new SIM cards after their prices became higher than the offer they present, meaning that the price of the SIM card jumped to LE 80 after the imposition of the development fees and the value added taxes, compared to LE 15 previously,” Hegazy elaborated in his statement to local newspaper.

According to Hegazy, the imposition of development fees on the new lines significantly reduced the sales of new SIM cards, and consequently led to a decline in the revenues of companies, and then decline in the revenues of the State in terms of its share in mobile companies' revenues.

The Ministry of Communications receives 6 percent of revenues of mobile companies, 1 percent goes to Information Technology Industry Development Agency (ITIDA), and 0.5 percent for the universal service fund and a similar percentage for research and development (R&D), excluding taxes.

“Even though the development fees were imposed as part of the increase in the development of state resources, the resources decreased and did not increase, while the mobile market was reduced,” Hegazy stated.

Meanwhile, CEO of Vodafone Egypt Alexander Forman said earlier that the decision to increase the development fee on the mobile SIM cards has contributed to controlling the market in terms of reducing the international call smuggling and regularity of sales in a typical manner, where the real customer appeared instead of the customer who was buying the SIM cards to benefit from the companies' offers on the new cards. The latter type of customers ultimately dispose of the SIM card after taking advantage of the first time buyer’s sceheme.

The Ministry of Communications’ data gives a different impression than reality. The decision to limit the sale of new SIM cards to branches of companies, and the high price of the card due to the development fee and taxes came to verify the real customers and not the customers who only seek to benefit from the offers of companies on the new cards, Forman added, stressing that the number of real customers who run calls are regularly growing.

For his part, Acting Chairman of the National Telecommunications Regulatory Authority, Mustafa Abdel Wahed, reduced the importance of the declining number of subscribers by pointing out that the cell phone market before the audit of subscribers’ data was selling 5 million SIM cards on a monthly basis, meaning 60 million SIM cards per year, which led him to wonder aloud whether Egyptians are, in fact, increasing by 60 million annually.

“The truth is that the real increase is 2 million SIM cards only and about 58 million cards are thrown away,” Abdel Wahed tells Business Today Egypt. “Currently, sales reach about 900,000 new cards monthly or 7 million cards per year. Does this mean that the market is more than 7 million annually? No, but what I mean is that the market still receives sales but they have declined after the decision to impede the sale of new lines in the branches of companies, and before auditing data,” Abdel Wahed explains.

“It's not just sales. Sales are not a real indicator of market demand, which will absorb only 2 million annually, even if 50 or 100 million cards are sold, it will end up decreasing to 2 million. This means the sale of SIM cards is at a rate higher than the market need.”

Abdel Wahed went on to point out that the number of mobile subscribers dropped by a large percentage after the companies began to audit the data of subscribers in 2014, plummeting numbers from more than 100 million to about 90 million subscribers. As of October 2018, the number ranged between 93.5 million and 94 million.

Comments

Leave a Comment