EFSA

The Egyptian Financial Supervisory Authority (EFSA) announced Sunday that it has received a tender offer from Orascom Investment Holding (OTH) to buy capital shared of the Sarwa Capital company.

EFSA allows mere transactions involved in financial control laws.

A number of 840 entities were granted licenses by the EFSA to operate in the microfinance sector.

The company posted 13.45 percent decline in its consolidated profits to stand at LE 15.65 million in Q1.

The offering would range from 5.21 pounds to 5.95 pounds per share.

Omran called on firms to expand their work to include pre-delivered residential units.

Omran said the authority will also work on preparing the legal framework for new financial tools, such as the Green Bonds.

A wrap-up for the most prominent business news of the day.

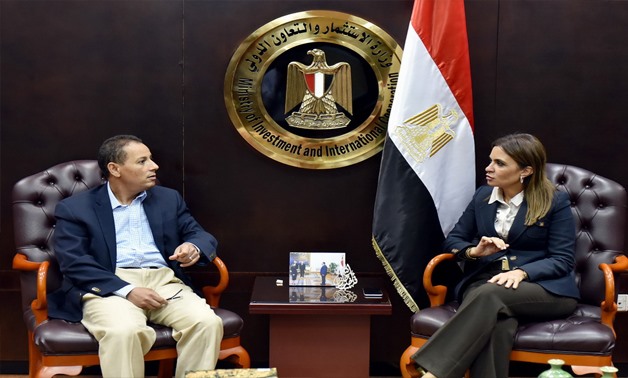

“EFSA is currently imposing an inclusive strategy for non-financial services to boost the role of that sector and provide needed funds for projects,” Nasr said.

The law decreases the fees of the financial leasing contracts by more than 70 percent with a maximum of LE 500 instead of LE 3,000.

Mohamed Omran will serve as the representative of the Egyptian Financial Supervisory Authority in the Central Bank’s board.

Mohamed Omran has been serving as the Head of the Egyptian Exchange (EGX) for two sessions since September 21, 2011 until August 6, 2017.

The CBE said it had no plans to launch a digital currency exchange.

The license will enable Pharos to expand its services in a way that helps its clients and their long-term investment plans.

Under the agreement, Amer Group will convert and transfer a part of its issued capital into global depository receipts (GDRs).

The number of beneficiaries from microfinance initiatives in that period increased 10 percent, registering 1.8 million, EFSA says.

Egyptian Financial Supervision Authority (EFSA) disclosed the 1st digital microfinance map, showing the licensed bodies that practice microfinance on Tuesday.

Financial leasing contracts’ value rose 7% to reach LE 11.8 billion in the first six months of 2017 from LE 11 billion in the same period last year.

Egypt’s Financial Supervisory Authority approves the issuance of Amer and Porto Groups for global depository receipts (GDRs) up to one-third of their capital.

Mohsen Adel will hold the post as a Chairman for the Egyptian Exchange (EGX) for a transitional period.

Most Read