tax

That was in a meeting he held with the prime minister.

President El-Sisi placed high priority on continuing intensive efforts to curb inflation, through integrated and consistent programs and policies.

During a panel discussion, Kouchouk emphasized the importance of recent legislative measures aimed at abolishing preferential tax treatments across all sectors

The council, chaired by the Prime Minister, will include heads of the Federation of Egyptian Chambers of Commerce, Federation of Egyptian Industries, and Egyptian Federation of Investors Associations

The minister added that Egypt has accumulated around LE 171 billion in the July 2023 – January 2024 period

Economic Expert and Member of Al Masreyin Al Ahrar (The Free Egyptians Party) Mohamed Badra attended Tuesday the National Dialogue's session on public debt and budget deficit putting forward two suggestions.

Chairman of the General Authority for Investment and Free Zones (GAFI) Hossam Heiba told press Monday that strategies are being set to bolster specific sectors.

Also, an Egyptian-Omani Business Forum was held to acquaint the Egyptian business community with investment opportunities in the neighboring Arab state.

The decree came out during a meeting the president held Sunday to discuss the FY2023/2024 draft budget.

Egypt's revenues rose to LE 572.55 billion during the period from July to the end of last December, compared to LE 499.63 billion during the comparative period of the previous fiscal year.

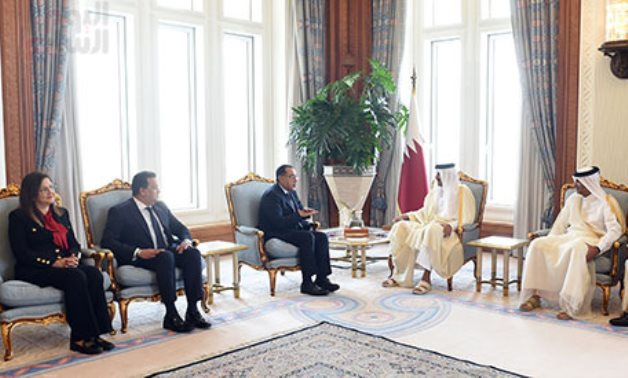

The agreement was signed during the PM’s first official visit to Doha, upon an invitation by his Qatari counterpart, to discuss future cooperation between the two countries.

Finance Minister Mohamed Maait said that the Ministry of Finance and the Egyptian Tax Authority are getting ready to launch an incentive program under the rubric “your bill, your protection, your prize” which is the first program of its kind to make the citizen a basic partner for the success of electronic taxes.

“The door will be opened for filing tax disputes after the end of the Eid al-Adha holiday, and until the end of December of this year; this will help alleviate the burdens on the productive sectors in light of the negative repercussions of the war in Europe,” the Finance Minister said.

Tax receipts from sovereign authorities increased by about LE 12.3 billion, or 11.8 percent, to reach LE 117 billion during 11 months, compared to about LE 104.7 billion during the same period of the previous fiscal year.

Egypt aims to achieve tax revenues of LE 1.16 trillion during the next fiscal year, compared to expected tax revenues of LE 983.01 billion during the current fiscal year.

Reda Abdel Qader, chairperson of the authority, called on the companies obligated to join the system in its seventh phase, to quickly implement the registration procedures as well as obtain the electronic stamp before June 15.

While checking the FY2022/2023 draft budget, President Abdel Fatah al-Sisi instructed the government to immediately prepare a bundle of financial and social protection measures.

In a press release on Sunday, he added that this comes within the finance minister’s directives in which the campaign will start in Gharbiya governorate.

The first tranche: Up to an amount of LE 250,000, an amount of LE 1,500 will be obtained.

Abdel Kader added that they are continuing to complete all stages of the system within the specified times.