Devaluation

In the 24 hours after the Central Bank of Egypt's (CBE) decision to float the Egyptian pound on Wednesday, leading to a significant decline of 62 percent in value, the pound displayed resilience

JP Morgan expects that any currency adjustment will be accompanied by an increase in deposit interest rates by an additional 2 percent

“We think more clarity on exchange rate policy would benefit trade and economic growth and trigger an increase in remittance inflows,” S&P wrote in its report

The committee head stressed that certain requirements must be met prior to any devaluation or currency adjustment, emphasizing the need for a sustained decline in inflation rates.

The bank stressed that the pound’s adjustment is simply part of a wider transition by the government toward a more flexible exchange rate regime

The revision comes in light of recent comments by the International Monetary Fund’s Managing Director, Kristalina Georgieva, and Egyptian officials over the past week

Capital Economics projects that the Egyptian pound will depreciate to 35 per dollar by the close of 2023, marking a 12 percent devaluation from its current rate of 30.95 per dollar.

What if Egypt won’t devalue its currency in the short term?

Hossam El Din's statements are made amid an expected rise in prices due to the devaluation of the Egyptian pound on Thursday.

In light of volatile economies the world faces nowadays, Bloomberg reviewed Egypt's economy in a report, referring to it as the traders’ refuge from volatility.

The ministerial decree issued in January amending the medicine prices included a review in August, but nothing has been issued yet, Pharmaceuticals Chamber said.

Egyptian financial services group Beltone Financial will launch a $1 billion investment fund in fixed income instruments in September.

Egypt’s exports increased 9.4 percent to $14 billion in the period between November 2016 and June 2017, after the devaluation.

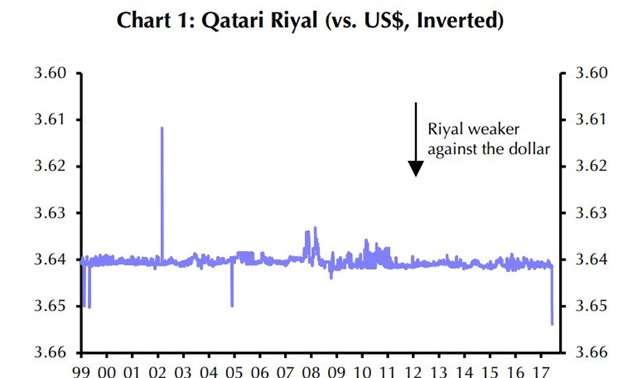

Qatar is unlikely to devaluate its riyal on strong foreign reserves and balance sheets, London-based consultancy Capital Economics predicted Sunday.

Fitch Ratings warned Tuesday that some Egyptian banks are still at risk and facing difficulties to meet minimum regulatory capital requirements due to the Egyptian currency’s weakness, following its flotation in November, and high exposure to foreign-curr

Most Read