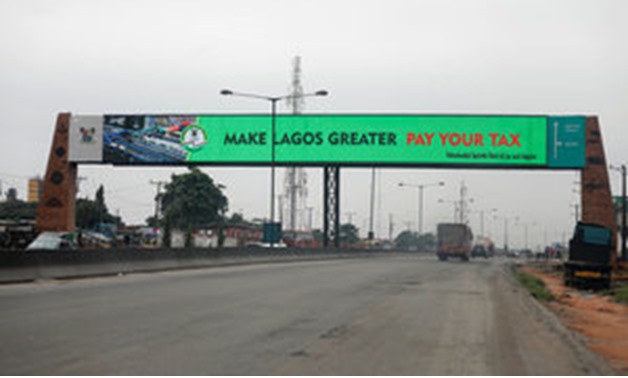

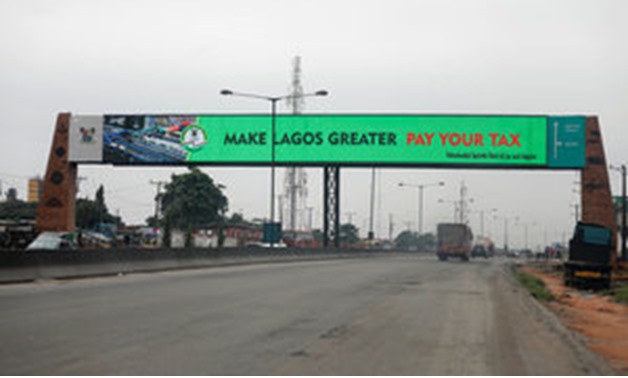

A sign advertising instructions on tax payment is seen on a billboard on the Lagos-Ibadan expressway in Lagos, Nigeria August 3, 2017.REUTERS

LAGOS - 4 August 2017: Nigeria and the International Monetary Fund disagree over how much the economy will grow this year, with the government saying 2.2 percent and the Fund opting for just 0.8 percent.

Either would be an improvement on last year, when Nigeria suffered its first recession in more than two decades as low crude prices and oil production slashed government revenues and caused chronic dollar shortages.

The government's forecasts, seen by Reuters on Thursday, are contained in a document titled: 2018-2020 Medium Term Fiscal Framework and Strategy Paper, which forms the basis for its 2018 budget, dated July 27.

It projects a big bounce back, to 2.2 percent this year, 4.8 percent in 2018 and 4.5 percent in 2019, before reaching 7 percent in 2020.

The IMF, however, is not as bullish, saying on Wednesday it expects Nigeria's economy to grow by 0.8 percent this year, with threats to growth remaining elevated.

"I think that risks are to the downside rather than the upside, but 2.2 percent isn't outside the range of the possible now that oil prices and oil output are recovering," said John Ashbourne, Africa economist at Capital Economics.

The OPEC member expects oil production to hit 2.3 million barrels per day and a price of $45 per barrel. It said oil production reached 1.9 million barrels between January and June 2017, including condensates.

Nigeria has promised OPEC to cap its crude oil output at 1.8 million bpd, although it does not include condensates in this total.

The country's economy contracted 0.5 percent in the first quarter, its smallest fall in five quarters of decline.

The government projects the naira's exchange rate to the dollar, which has traded at around 305 on the official market since 2016, to remain stable while inflation will decline but remain in double-digits at 12.42 percent next year.

Nigeria has at least six exchange rates which it has used to mask pressure on the naira after a drop in oil price caused foreign investors to flee, triggering a currency crisis.

The central bank has been working to converge the rates through dollar interventions but that is burning out reserves.

"Should there be any harmonisation in FX rates – as encouraged by the multilateral agencies – then an FX assumption of 305 is likely to prove unrealistic," said Razia Khan, chief economist Africa at Standard Chartered Bank.

Nigeria suffered significant revenue shortfalls in the first half of 2017, with interest payments remaining as high as 40 percent at end of June.

The country estimates record spending of 7.94 trillion naira ($21.75 bln) next year, up 6.7 percent from the sum budgeted for 2017 with deficit rising to 2.45 percent as a percentage of GDP.

"In order to sustain spending of anything close to 7.94 trillion naira, Nigeria will need to do a great deal more to boost non-oil revenue mobilisation," said Khan.

Comments

Leave a Comment