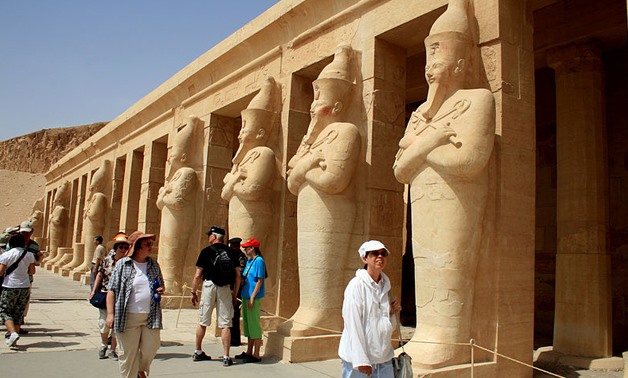

Tourists to Egypt- Karelj - Creative Commons via Wikimedia

CAIRO – 22 June 2017: A 51 percent year-on-year increase in tourist arrivals in Q1 2017 is positive for Egyptian banks, Moody’s Credit Outlook noted Thursday.

More tourist arrivals will allow direct and indirect borrowers of the sector to repay their debts to banks, Moody’s said, adding that tourist revenues in foreign currency would eventually help banks to meet the hard currency needs of their clients.

The Commercial International Bank (CIB) was said to benefit the most from the rebound in tourist arrivals as Moody’s said it is heavily involved in the private sector “with around 8 percent of its total loans exposed to tourism, higher than an average of 3 percent,” the report noted.

Tourist revenues in Q4 2016 jumped nine percent quarter-on-quarter, recording $826 million up from $758 million in Q3 and $10 million in Q2.

The indirect effect of tourism on the economy, for example food buying and offering cleaning services, amounted to 7.2 percent of GDP, according to a World Travel and Tourism Council report.

“The tourism industry’s revival will positively affect the cash flows of borrowers in hospitality and related sectors such as transport, construction and food, and lead to job creation,” Moody’s expected.

Although Egypt has taken economic reform measures including floating its currency, the country has not yet addressed the issue of the availability of foreign currency, which if solved would help banks in decreasing their net foreign liability position, Moody’s said.

Comments

Leave a Comment