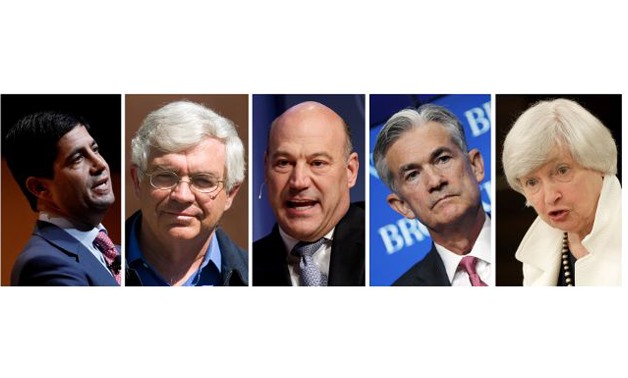

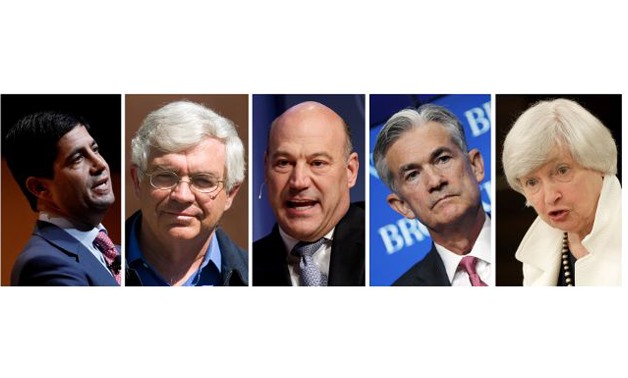

A combination photo of the five U.S. Federal Reserve Chair contenders: Kevin Warsh (L to R), John Taylor, Gary Cohn, Jerome Powell and present chair Janet Yellen in Washington - REUTERS

NEW YORK – 26 October 2017: U.S. stocks slumped on Wednesday, with the Dow Industrials and S&P 500 suffering their worst day in seven weeks, on a batch of soft quarterly earnings and a rise in bond yields.

Benchmark U.S. 10-year note yields hit a seven-month high of 2.475 percent, buoyed by economic data, recent optimism over progress on tax reform by U.S. President Donald Trump's administration and anticipation of a nominee to head the Federal Reserve.

Equities pared losses as yields retreated, following a Fox Business interview with Trump in which he said he was still considering keeping current Fed Chair Janet Yellen in the position. The 10-year last fell 9/32 in price to yield 2.4371 percent.

"It is possible the market may be taking some solace that Yellen is still in the mix," said Mike Beale, senior managing director at U.S. Bank Private Wealth Management in Portland, Oregon.

"The market may be saying, maybe one of the more hawkish, (John) Taylor or (Kevin) Warsh, is off the table."

Low interest rates have been a driving factor in the 8-year bull market, with investors pushed into equities as other lesser-yielding instruments are viewed as unattractive by comparison.

Earnings season so far has been largely positive, with 72.1 percent of the 165 S&P 500 companies that have reported to date topping expectations, matching the average for the past four quarters.

However, with U.S. indexes at record levels, investors have scrutinized earnings to see if they justify stretched valuations.

Also weighing on sentiment: President Trump and the U.S. House of Representatives' top tax law writer reopened the door on Wednesday to changes in the 401(k) retirement savings program, just days after Trump seemed to rule out such a step. The debate could present another hurdle to a tax reform deal.

Downbeat earnings from AT&T sent shares in the United States' second-largest wireless carrier down 3.9 percent, pulling down other telecom stocks Verizon and CenturyLink

Boeing, off 2.8 percent, surprised investors by revealing a $329-million charge for its troubled KC-46 aerial refueling tanker program in quarterly results.

The Dow Jones Industrial Average fell 112.3 points, or 0.48 percent, to 23,329.46, the S&P 500 lost 11.98 points, or 0.47 percent, to 2,557.15 and the Nasdaq Composite dropped 34.54 points, or 0.52 percent, to 6,563.89.

Selling was broad, with each of the 11 major S&P sectors in negative territory.

AMD shares tumbled 13.5 percent after the chipmaker flagged competitive pressures with a forecast that pointed to a drop in revenue in the fourth quarter from the third.

Chipotle plunged 14.6 percent after the burrito chain posted disappointing sales and earnings, adding to a raft of bad news for the company this year.

Declining issues outnumbered advancing ones on the NYSE by a 2.96-to-1 ratio; on Nasdaq, a 2.07-to-1 ratio favored decliners.

About 7.3 billion shares changed hands in U.S. exchanges, above the 5.91 billion daily average over the last 20 sessions.

Comments

Leave a Comment