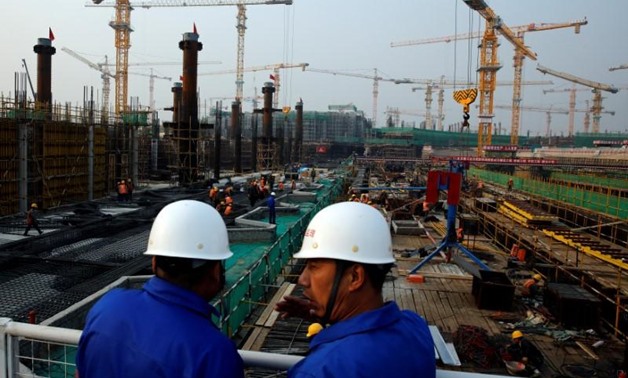

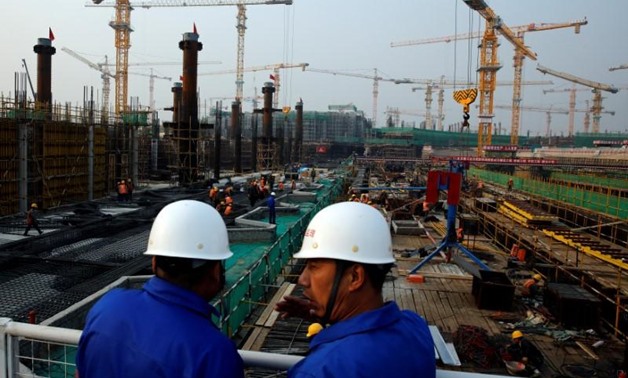

Workers survey the construction site of the terminal for the Beijing New Airport in Beijing's southern Daxing District, China October 10, 2016. REUTERS/Thomas Peter/File Photo

BEIJING – 19 October 2017: China’s economic growth looked set to accelerate for the first time in seven years this year, after hardly skipping a beat in the third quarter, but efforts to cut risks in property and debt are beginning to weigh on parts of the world’s second-largest economy.

Beijing’s push to consolidate and restructure its industrial sector have paid dividends as factory output beat expectations, while strong fiscal spending and sustained public investment helped boost domestic demand.

But concerns remain that much of the growth is debt-driven, with central bank governor Zhou Xiaochuan on Thursday warning about household and corporate leverage.

A crackdown on rising financial risks and measures to cool he property market, which some expect to accelerate after the congress, has already started to bite. Growth in new construction slowed and property sales dropped for the first time in more than two-and-half years in September.

In all, the economy was solid and expected to comfortably beat the government’s target of around 6.5 percent for this year and 2016’s growth rate of 6.7 percent, which was a 26-year low.

“The data show that some deleveraging is continuing and government reforms are working but growth is still being supported at a reasonable rate,” said Kaori Yamato, senior economist at the Mizuho Research Institute in Tokyo.

The economy grew 6.8 percent in the third quarter from a year earlier, in line with the estimate in a Reuters poll and down from 6.9 percent in the second quarter, the National Bureau of Statistics said on Thursday.

While the numbers met economist expectations, they raise questions about the more optimistic forecast flagged by the country’s central bank chief this week. Zhou on Sunday said gross domestic product (GDP) could grow 7 percent in the second half.

Analysts had penciled in a gradual GDP slowdown due to an expected softening in property investment and construction as more cities try to cool surging housing prices, while a government campaign against riskier lending pushes up borrowing costs.

“Unequivocally, the property boom has peaked,” said Rosealea Yao, a property analyst at Gavekal Dragonomics. “Given how fast the sale numbers are declining, we expect no big rebound this time.”

DEBT DRIVEN

China’s economy has surprised global financial markets and investors with robust growth so far this year, driven by a renaissance in long-ailing “smokestack” industries such as steel and strong demand from Europe and the United States.

At the same time, there are concerns about the state’s growing role in the economy: the acceleration in year-on-year state investment growth outstripped private investment growth in September.

Analysts and global economic bodies such as the International Monetary Fund warn Beijing is still too reliant on debt-fuelled stimulus to meet fixed growth targets. Rating agencies estimate the overall debt burden at almost three times economic output.

On the sidelines of a key, twice-a-decade Communist Party Congress on Thursday, central bank governor Zhou said excessive optimism could lead to a “Minsky Moment”.

He was referring to a theory named after economist Hyman Minsky in which debt or currency pressures trigger a collapse in asset prices after long periods of growth.

His comments come on the 30th anniversary of the Black Monday Wall Street crash.

“China’s high debt burden is an area where reform is most urgently needed but progress has been the slowest,” said Chi Lo, senior economist at BNP Paribas Asset Management.

“The rapid growing debt level is mainly due to misallocation of capital to benefit the state-owned enterprises at the expense of the private sector.”

In the opening speech of congress this week, President Xi Jinping said China will deepen economic and financial reforms and further open its markets to foreign investors as it looks to move from high-speed to high-quality growth.

However, while expressing support for market reform and private firms, Xi also called for stronger, bigger state firms.

ROOM FOR REFORMS

While policymakers’ efforts to curb property market speculation and cut debt are hurting growth in some parts of the economy, activity has been supported by better-than-expected expansion in trade and bank lending.

Beijing has set a modest growth target of around 6.5 percent for 2017, theoretically allowing policymakers more room for structural reforms.

China’s factory output grew 6.6 percent year-on-year in September, beating expectations, while fixed-asset investment expanded 7.5 percent in January-September, missing forecasts.

Comments

Leave a Comment