FDI sources for Egypt- via Renaissance Capital

CAIRO – 21 August 2017: Oil and gas, commercial retail, real estate and consumers’ goods fields are the sectors with the highest investment potential in Egypt, Russia-based research firm Renaissance Capital said.

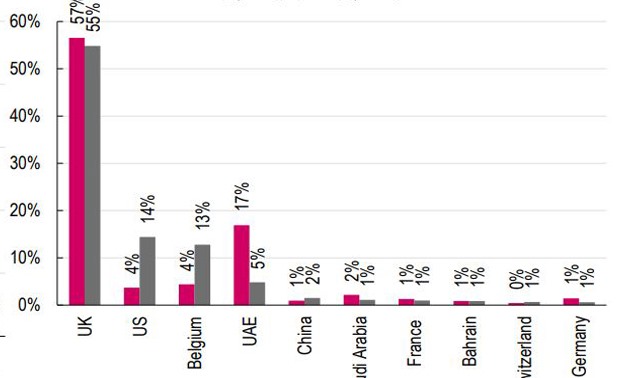

In a research note published on August 17, Renaissance Capital said the United Kingdom, the United States and Belgium are the largest foreign investors, while the UAE represented the largest Gulf source of investment for Cairo.

Being the largest source of FDI, the UK invested a total amount of $4.8 billion over the first nine months in fiscal year 2016/17, shaping 55 percent of total investments and increasing 11 percent in a year-on-year level (YoY).

The UK was followed by the U.S., with a 14 percent stake in the third quarter (Q3) of FY2016/17, marking a 4 percent YoY increase, the report said.

On the other hand, Arab countries slowed their investments as the UAE’s contribution fell to record 5 percent in Q3 FY2016/17, compared to 17 percent in the corresponding quarter last year.

From a sector perspective, 50 percent of the investments in Q2 FY2016/17 were directed to the oil & gas sector at $4.1 billion, especially after paying large portions of the outstanding debts to foreign oil firms after easing the dollar shortage.

Real estate, manufacturing and construction still account for an insignificant share of total FDI, with respectively 0.7 percent, 1.7 percent and 0.5 percent shares in Q2 FY2016/17.

“We believe commercial real estate could be likely to see a greater impact from continued foreign interest, given Egypt’s limited mall space and low penetration of modern retail as we have already seen investments from UAE (Lulu, Majid Al Futtaim) and Saudi Arabian (Hokair, Al Othaim) groups in this sector,” Renaissance Capital stated.

Other sectors such as retail, banking utilities and tobacco sectors, are expected to see a breakthrough in investments in the upcoming period.

Comments

Leave a Comment