New York – September 24, 2024: “Reforming the global financial structure has become a necessity for achieving climate and development agendas,” states Minister of Planning, Economic Development, and International Cooperation, Rania Al Mashat.

Highlighting the alarming rise in debt levels among developing nations, she explained that this was exacerbated by soaring debt servicing costs that limit fiscal space for achieving sustainable development goals.

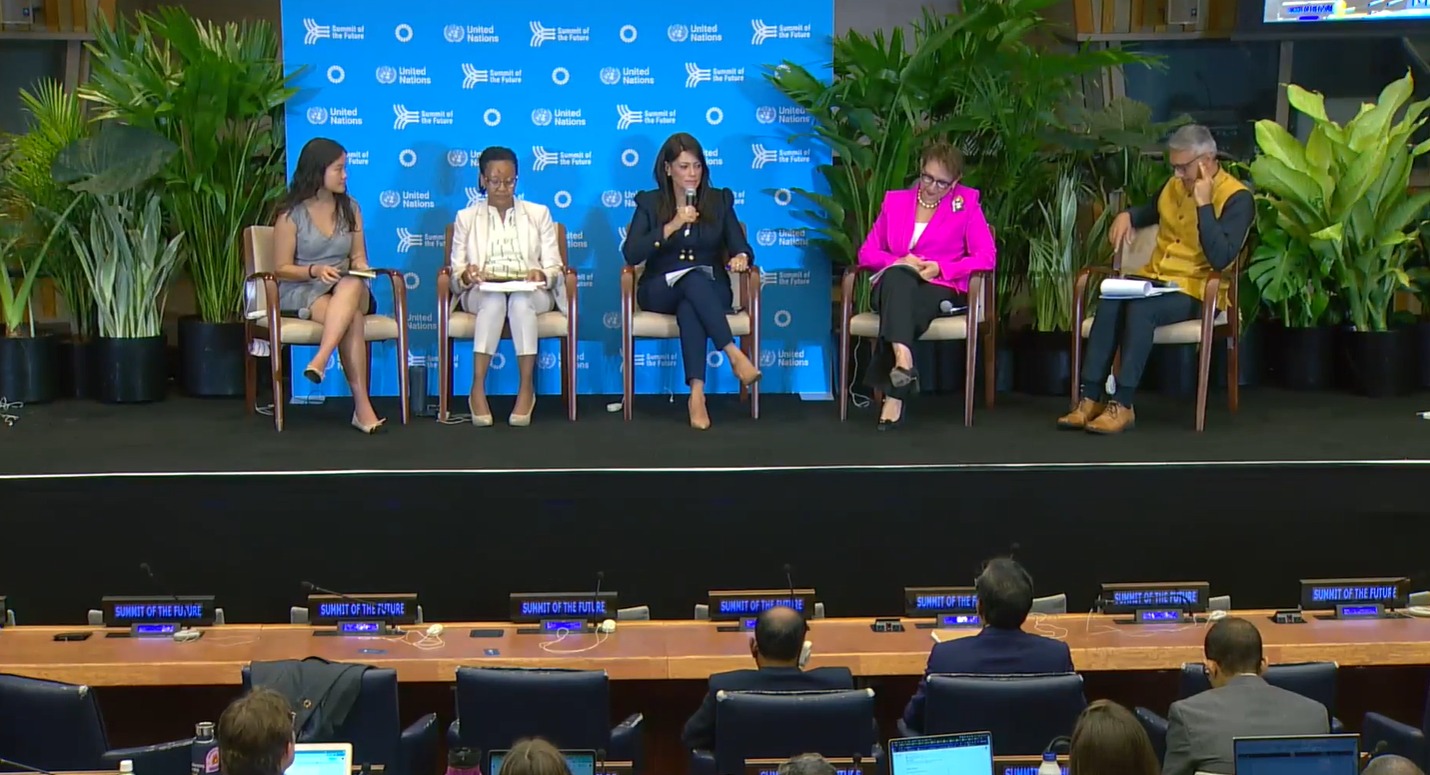

During the 79th session of the United Nations General Assembly and the “Summit of the Future” in New York, Al Mashat, engaged in critical discussions on the restructuring of the global financial system and addressing debt challenges faced by developing countries.

Participating in a session titled “Addressing Debt Challenges for Sustainable Development,” the minister pointed out that developmental gaps hinder progress in many countries, exacerbated by recent global challenges that undermine national systems.

She emphasized that domestic resources alone are inadequate to bridge the financing gap, compelling nations to turn to commercial financing or bond issuance, which can escalate borrowing costs and lead to economic crises.

The session featured contributions from key figures including Rebeca Grynspan, Secretary-General of the United Nations Conference on Trade and Development, and José Antonio Ocampo, former Minister of Finance of Colombia.

During the session, Al Mashat underscored the necessity for coordinated efforts among creditors to address these issues effectively.

She advocated for multilateral solutions, including the G20 Common Framework for Debt Treatment, which aims to align efforts among major creditors, including non-traditional lenders such as China and India.

Al Mashat also stressed that enhancing financial stability through liquidity support is vital, suggesting that the allocation of Special Drawing Rights from the International Monetary Fund could provide immediate relief without exacerbating debt burdens.

The minister highlighted the long-term sustainability of debt and the role of multilateral initiatives, such as the Heavily Indebted Poor Countries (HIPC) Initiative, which offer targeted debt relief, freeing up essential resources for development.

Al Mashat also participated in a high-level discussion on the “International Financial Architecture for the 21st Century,” emphasizing the need for reforms in international financial institutions.

She argued that the financing tools available must be utilized effectively to address both climate and development agendas simultaneously, calling for improved representation within these institutions to better reflect the needs of developing economies and stressed the importance of collaboration among various entities to bridge developmental gaps.

There is a pressing need for additional financing, she said, noting that some countries allocate over 60 percent of their GDP to debt servicing. To drive transformation, she called for a mix of public and private investments and emphasized the importance of practical examples and coordinated efforts in tackling these challenges.

Comments

Leave a Comment