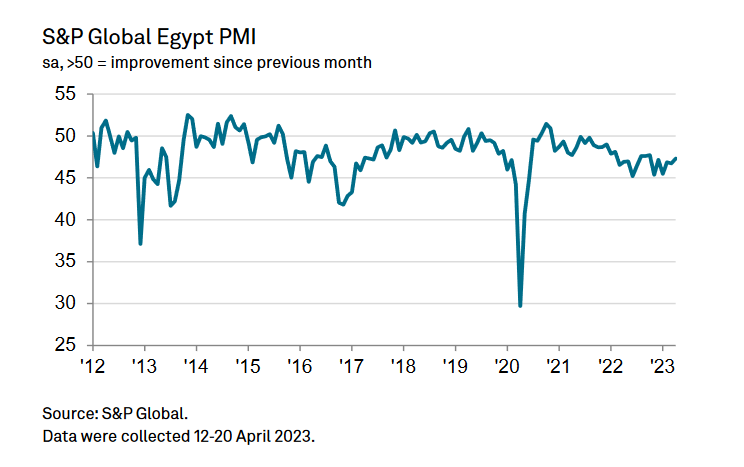

In April, Egypt's non-oil business activity continued to decline for the 29th consecutive month, but at a slower pace compared to the previous 6 months, according to S&P Global.

The decline in demand levels was slower, and inflationary pressures eased, leading to an increase in output and new orders data, which rose to six- and four-month highs, respectively.

However, Egypt's Purchasing Managers’ Index (PMI) remained below the 50 mark which indicates growth, recording 47.3 in April, up from 46.7 in March.

The calmness in currency markets led to reduced pressure on import prices, resulting in the softest rise in purchase costs in a year. Nonetheless, import controls and high prices continued to affect inventories.

"According to surveyed businesses, weak client demand linked to high inflation continued to play a key part in dampening sales," S&P Global said. "Restrictions on imported goods were still cited by companies as an inhibitor to capacity levels."

The PMI's sub-index for overall input prices fell to 58.7 in April from March's 62.8, and that for purchase prices went down to 59.9 from 64.3.

The outlook on the sector’s activity fell to its lowest on record in April, as businesses felt uncertain about the upcoming period’s activity levels, with surveyed participants pointing to weak demand both domestically and abroad, and high price levels, despite a slight uptick in positivity due to a softer rate of cost inflation.

David Owen, Senior Economist at S&P Global Market Intelligence, suggested that headline inflation in Egypt should begin to soften over the coming months, after hitting a near six-year high of 32.7 percent in March, which will help to ease the cost-of-living crisis.

Comments

Leave a Comment