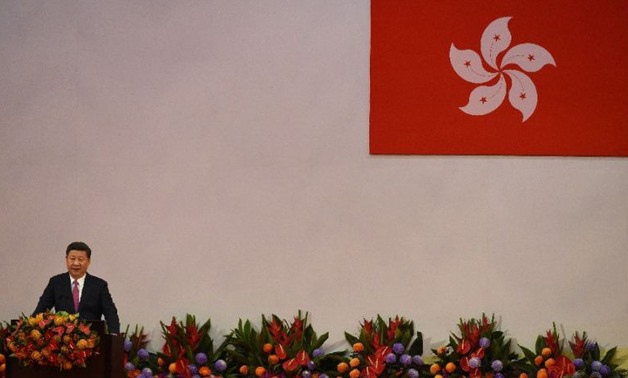

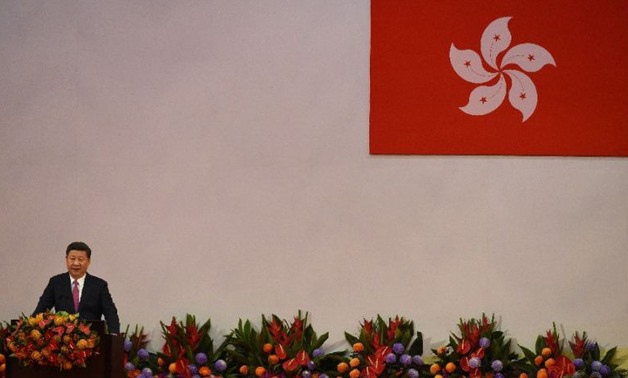

China's President Xi Jinping gives a speech following the swearing-in of Hong Kong's new Chief Executive Carrie Lam as the territory's new leader during a ceremony at the Convention and Exhibition Centre in Hong Kong, on July 1, 2017 (AFP/Anthony Wallace)

Beijing- 17 July 2017:China posted better-than-expected second quarter growth on Monday, but analysts warned that the momentum will not last as authorities clamp down on rising debt.

The economy expanded 6.9 percent in April-June, the same as the previous three months and better than the 6.8 percent tipped in an AFP survey.

"The national economy has maintained the momentum of steady and sound development in the first half of 2017, laying a solid foundation for achieving the annual target and better performance," national statistics bureau spokesman Xing Zhihong said.

"However, we must be aware that there are still many unstable and uncertain factors abroad and long-term structural contradictions remain prominent at home," Xing told reporters.

Industrial production grew 7.6 percent in June while retail sales were up 11 percent, both better than the previous month, according to the official data.

But analysts expect a deceleration of the overall economy.

"China's strong first half to the year won't last," Julian Evans-Pritchard, China economist at Capital Economics, said in a note.

"The recent crackdown on financial risks has driven a slowdown in credit growth, which will weigh on the economy during the second half of this year," he said.

Debt-fuelled investment in infrastructure and real estate has underpinned China's growth for years but Beijing has launched a crackdown over fears of a potential financial crisis.

Fitch Ratings on Friday maintained its A-plus rating for the country for China but said its growing debt could trigger "economic and financial shocks".

The statement followed Moody's decision in May to downgrade China for the first time in almost three decades on concerns over its ballooning credit and slowing growth.

President Xi Jinping called for tougher regulations to crack down on financial risks during a weekend National Financial Work Conference, which sets the tone for reforms, according to state media.

The government will continue to deleverage the economy through prudent monetary policy and by reducing leverage in state-owned enterprises, Xi said.

The conference showed that authorities will intensify financial regulation "unprecedentedly, through a much more centralised and empowered organisational set-up", ANZ's China economist Raymond Yeung said in a note.

"Debt reduction will become an important consideration in monetary policy," Yeung said, predicting more corporate defaults and a tightening of credit policy among banks.

Despite the economic deleveraging, however, "we do not think this event will trigger an immediate monetary tightening".

Analysts expect tighter restrictions on property purchases and bank lending will continue to weigh on the economy in the months ahead.

But a sharp slowdown in the second half is unlikely as policymakers prepare for an important Communist Party congress later this year that will likely cement Xi's place as the most powerful leader in a generation.

"It is therefore highly probable that authorities will use the resources and policy tools at their disposal to ensure a positive economic outcome," Citibank said in a note.

The government has trimmed its 2017 growth target to around 6.5 percent, after it expanded 6.7 percent in 2016 -- its slowest rate in more than a quarter of a century.

While the Nomura Group raised its 2017 growth forecast from 6.7 percent to 6.8 percent, the Tokyo-based financial firm said in a note that it still expects a "gradual slowdown" as the property sector appears set to "lose steam" in the second half.

Premier Li Keqiang said last month that the country could reach this year's economic growth targets.

Last quarter's growth momentum had continued into the current one, he said, noting that traditional economic indicators such as power generation and consumption, and new business orders had increased "significantly"

Comments

Leave a Comment