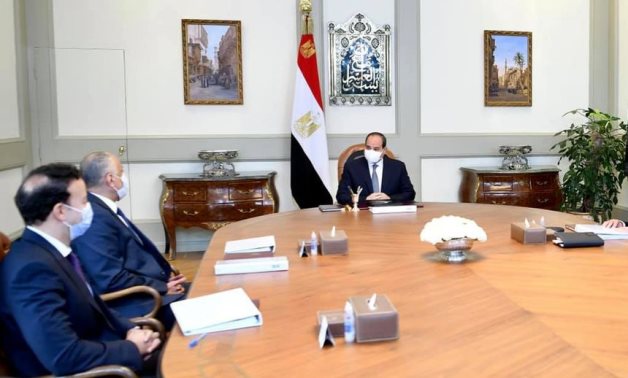

President Abdel Fatah al-Sisi in a meeting with CBE governor and officials on March 14, 2021. Press Photo

CAIRO – 15 March 2021: President Abdel Fatah al-Sisi instructed Sunday the Central Bank of Egypt (CBE) to crystallize and launch a real estate financing program targeted at low and middle income citizens.

The program should support their ability to purchase residential units through long-term loans extending to 30 years with an interest rate of maximum three percent.

Presidency Spokesperson Bassam Rady indicated in a statement Sunday that the president had met with CBE Governor Tarek Amer, Deputy CBE Governor for Banking Stability Gamal Nagm, Deputy CBE Governor for Monetary Stability Ramy Abou El Naga, and Senior Under-Secretary of CBE May Abou El Naga.

The officials displayed CBE activities within the framework of the state's financial and monetary system.

The CBE governor affirmed that the current status of foreign reserves is "strong and safe" pointing out that is the reason the exchange rate has been stable. He added that has also caused liquidity in foreign currencies, which had a remarkable impact on overcoming the COVID-19 repercussions in 2020.

In that context, the president praised the performance of CBE for it has been harmonious with the work of all governmental institutions and keeping up with the general economic orientation of the state.

The CBE governor also presented the outcomes of the 2015 presidential initiative targeted at micro, small and medium enterprises. The total volume of financing provided through the initiative has reached LE234 billion disbursed to 1.26 million commercial and industrial establishments creating one million job opportunities.

The president instructed extending that financing program until the end of 2021 allocating additional LE117 billion.

Further, Governor Amer displayed the updates on restructuring and developing the Agricultural Bank. He explained that 320,000 farmers have been exempted from payback of loans worth a total of LE660 million. The CBE also pumped LE4.5 billion as loans with low interest rates to small agricultural projects as well as the renovation and modernization of irrigation methods.

The CBE also partially financed milk collection centers project, and injected LE2.5 billion in livestock projects that consisted of hundreds of thousands of cattle and LE3 billion in the national project of veal focusing on breeding.

On that front, the president directed carrying on with the efforts deployed to develop the Agricultural Bank given its vital salience in pushing forward the agricultural sector across the country.

Moreover, the president got briefed about the measures taken to promote financial inclusion, which has hit 50 percent among Egyptains. There are also financial services designed for women raising their access to credit and savings.

Finally, the CBE governor stated that LE550 billion were collected in FY2019/2021 through the governmental payment collection system implemented in partnership with the Ministry of Finance. He further noted that Miza payment card had significantly contributed to that achievement as it is now carried by 23 million citizens.

Comments

Leave a Comment