Central Banks of Egypt – File Photo

CAIRO - 5 October 2022: The Egyptian banks began on Wednesday implementing new instructions regarding setting a limit for daily dollar withdrawals from automated cash teller machines (ATMs) abroad, up to LE 20,000 per month (around $1,000) depending on the type of the card.

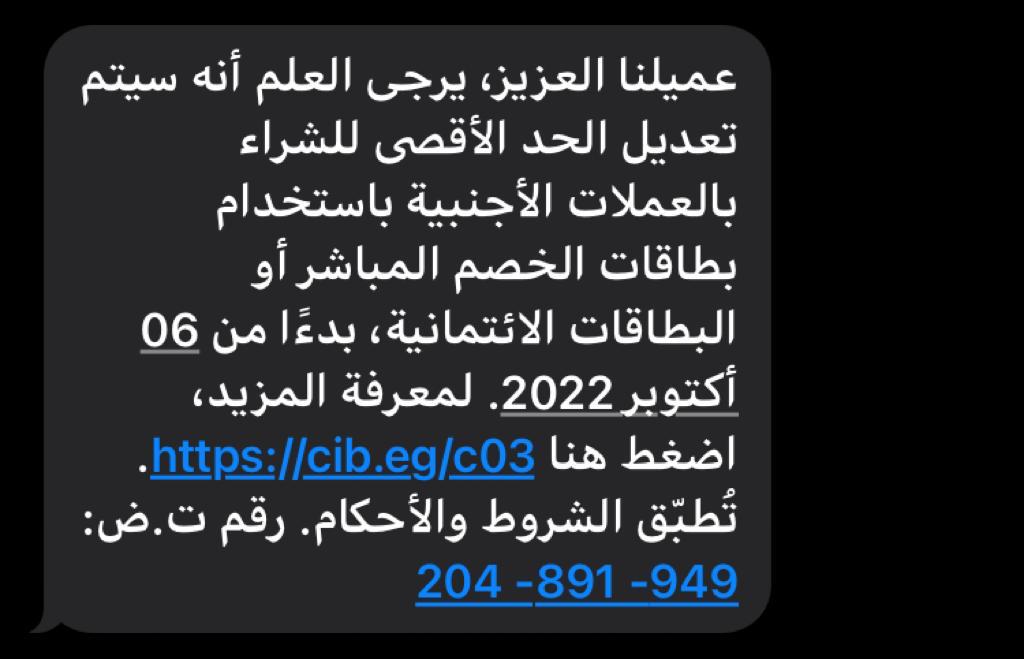

On Tuesday, public and private banks sent text messages to their customers stressing the need to pay attention to the maximum withdrawal limit when traveling abroad, for holders of classic cards.

The maximum limit for using the card in foreign currency within 30 days is the amount of the credit limit of the credit card, knowing that the 30 days will be calculated with the first foreign purchase transaction in foreign currency.

These instructions are similar to what happened before the massive flotation of the pound against the dollar at the end of 2016.

Upon this decision, the Central Bank is in the process of taking strict measures to try to preserve the decreasing hard currency in its coffers, due to Egypt's periodic obligations to pay services and debt installments.

The exchange rate of the pound continues to decline daily against the dollar at a rate of a few piasters, to approach the barrier of LE 20 per the dollar, up from LE 15 per the dollar months ago, losing around 25 percent of its value. However, the exchange rate of the dollar hits LE24 in the black market.

The International Monetary Fund (IMF) requires Egypt to commit to setting a “realistic” exchange rate for the pound against the dollar and the rest of the foreign currencies approved in it, in exchange for agreeing to grant the government a new batch of loans.

Over the past few weeks, there was news about the banks’ intention to limit withdrawals and purchases from abroad through automated cash teller machines, but official statements lied all the time, until bank customers were surprised by messages confirming the validity of what was reported.

It is usual for customers to use bank cards outside Egypt, whether for purchases or cash withdrawals, to obtain cash in the same currency of the country in which it is located, or to pay directly when making purchases in transactions where payment is available directly via cards.

Public and private banks imposed additional fees on each withdrawal transaction in addition to the established commission in an effort to rationalize the customer for his external uses, as well as to provide the high cost of managing foreign currency, in order to push customers to reduce withdrawal transactions except for necessity, within the framework of attempts to reduce the withdrawal of currency at a high value.

The discount commission is established between the bank issuing the card in Egypt and the bank in the country outside Egypt, in return for using a machine belonging to an external bank, but the fees are collected by the bank.

Comments

Leave a Comment